Startup business plan: The first step to any startup is to start with an idea. Once you have an idea, the immediate strategy is to think about its reach and potential. This is one of the biggest differences between a small business approach vs startup. In a small business approach, you can immediate start with the problem/solution without having to think too much about scalability and expansion. These occur organically.

However, in a startup, you must think about the size of your market, potential market capture. Ultimately if yours is a startup asking for funds, you must create a compelling statement about the return on investment. In this article, we will focus on writing a business case for a startup and its key components.

How to write a startup business plan?

You can find plenty of free templates to write a startup business plan. My advice would be to start with a presentation framework that gives you broad headings to your business plan. You can reuse this presentation to influence your detailed business plan. However, you can start with a word document if you prefer capturing your thoughts together. But make sure that your startup business plan has the following components.

Components of a Startup Business Plan

A startup business plan must have the following components. These components define the main elements of your business plan. The best way to represent your business idea in a snapshot is the Business Model Canvas. Read through – how to use business model canvas for a startup for more details.

A good business plan must have the following components:

- Business Problem: Identify the user issue and urgency, explaining why solving it is imperative for your startup’s success.

- Customer Segment: Define the target customers and emphasize scalability for investor interest. Achieving product-market fit is crucial.

- Business Value: Articulate the tangible value your startup provides, highlighting unique selling points that set it apart.

- Market Size: Present the Total Addressable Market and potential market capture to showcase growth potential.

- Competitors: Analyze potential competitors, their segments, pricing, and customer sizes, and explain how your solution can outperform them.

- Revenue and Financial Projections: Provide detailed revenue projections and ROI analysis to demonstrate the business’s growth potential.

- Team, Experiences, and Why You, USP: Highlight your team’s strengths, experiences, and vision to showcase your ability to execute the plan effectively.

Business Problem

This indicates the user issue or problems that they are facing. Startups thrive on problems and finding creative ways to provide user convenience, accessibility or ease. These guiding factors give a context for either an investor or potential client about your startup idea.

When you talk about the problem, make sure that you talk about why it is a problem. Consider the emotional needs, intensity of the challenge and why it is imperative to solve it. Most importantly, talk about the urgency of the situation and why your solution is timely to help.

Customer Segment

Customers indicate a segment of users that you’re focussing on. In a B2B context, these customers are other businesses. For such customers, you must think about the user, buyer and business challenge. In a B2C context however, the buyer is also the user. The most important thing an investor will look for is scalability of a business idea. A customer for investors represents a user segment or the number of users having this problem.

An investor isn’t interested in a single customer. He/She is interested in a product market fit that can satisfy multiple customers. In fact one of the most common reasons why startups fail is not achieving product market fit.

Business Value

Any business exists to give value to the user. If a business fails to provide benefit, then we must question its existence. If you’re able to provide a tangible value, you must be able to articulate it in a business plan. This value can be in the form of time or cost saving, improved efficiency or entertainment. Value doesn’t always represent money. You can use related aspects such as time, efficiency and error reduction which can be extrapolated into financial gain.

For a startup, this business value is combined with its Unique Selling Point which differentiates it from the rest of the businesses.

Market Size

An investor will only be interested if your startup idea has scalability. Remember, the biggest difference between startup and small business is in its scalability. Start with a top-down or bottom up approach. Identify the Total Addressable Market for your solution.

You can use this to assume a % of market capture – usually <5% to indicate the potential market you can approach. The best way to identify your potential market capture is by looking at companies similar to you. They might not offer the same solution, but even related ones provide great comparison.

Competitors

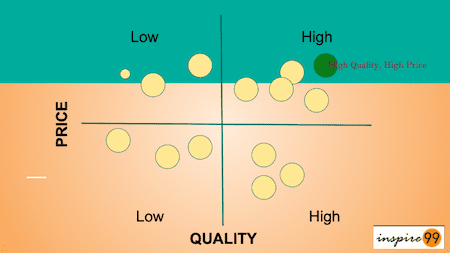

No matter how unique your business is, you’ll always have competitors. Competition is the sign of a healthy market. Make sure that your startup business plan has a section about potential competitors. When you speak about competitors, talk about which segment they operate in, price and customer sizes.

These competitors give an investor confidence in the market size. Once you have this competitor list, make a Matrix/table about why your solution can be better. Indicate what parts of the problem isn’t addressed by your competition.

Revenue and financial projections

This is the most important section in your startup business plan. An investor is usually most interested in their Return of Investment. The best way to convey this ROI is by showing potential revenue projection. Everyone knows that these are estimates, but these projections give a great insight into growth potential.

Make sure that you highlight your assumptions clearly, gather as much relevant data as possible. As a part of this section – talk about your pricing model, churn, increase in license rates etc. The business plan is as strong as its details. Find a comparative business in a similar segment – it adds credibility to your approach.

Team, Experiences and Why You

The only way a business plan is real is by having people to help you achieve it. Give a detailed explanation about your team, people that believe in your idea. Investors like a strong team and the fact that someone else believes in your idea and is willing to take a risk.

A strong team is a great indicator of your ability to work with people and motivate people with a vision. Make sure that you add details about your core team and a plan to expand.

Each of these sections are very important to provide a comprehensive view of your startup strategy. Hope this gives you an insight on writing a startup business plan. If you have any questions or insights, please share below for further engagement.

This is an informative post